According to CNBC, we should all be bummed that Silicon Valley DJs, comedians, acrobats and event planners are losing gigs due to coronavirus.

Here’s what I’m thinking.

The Valley has been flush with cash for this ridiculously long bull market run and unprecedented private equity boom. Or bubble. You say tomato, I say tomahto.

Contractors have had a sweet gig for like a decade now – they really should be able to handle a little hiccup when we’re all in the midst of a global pandemic and, you know, people are dying.

On the other hand, if you’re just now trying to jump on the gravy train, you’re timing really sucks.

I’m just saying.

My latest on COVID-19’s impact on tech and small businesses: Silicon Valley businesses who made their living from tech industry events are suddenly staring at blank calendars and layoffs https://t.co/wzLSOzMuhd

— Sal Rodriguez 🕷 (@sal19) April 4, 2020

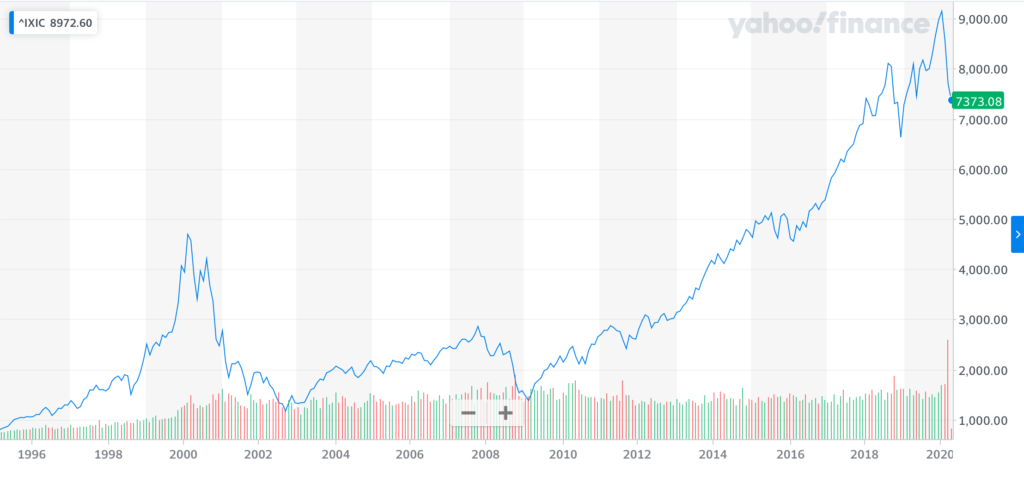

Should we cry for investors who lost 25% in the broad market selloff – including me? The thing is, the Nasdaq quadrupled over the past decade before the pandemic hit. I mean, just look at this chart. None of us should be complaining.

It’s certainly virtuous to support small businesses in these uncertain times. But not all small businesses are created equally. Many exist solely as a result of this boom/bubble we’ve enjoyed for so long. That’s certainly true in the Valley.

Sorry to say, many of those businesses won’t survive the crisis. Nor should they. That’s just the way competitive markets and cyclical economies work. That’s just the cycle of business life.

Catastrophes are nature’s way of reminding us that we’re not really in charge. That there are bigger forces in the world. Forces capable of physical and economic destruction. Forces that are completely out of our control.

That’s why disasters are terrifying experiences. They’re also opportunities to come out the other side and face the future a little wiser and a lot more humble.

Having lived through a few of these cycles I can tell you with absolute certainty that there is always light at the end of the tunnel. We always come back bigger and stronger than before.

Until then, here’s my advice: Embrace the chaos. May as well. It’s not like you have a choice.

Image credit ddh Photos / Flickr