At a party the other day, I walked right into the middle of a debate about the effectiveness of the Fed’s monetary policy. It must have been Karma’s payback for something terrible I’d done, but before my margarita and I knew it, we were drawn into the fray with no hope of escape.

Apparently – unbeknownst to me – everyone and his brother is studying whether Ben Bernanke’s quantitative easing experiment worked or not. That got me thinking, which I prefer not to do while drinking. It ruins the buzz. Once those little synapses start snapping, it’s hard to get them to stop.

Anyway, the conclusion I ultimately reached is that macroeconomists are more or less clueless. I’ll explain how I got there in a minute, but first, I should probably take a moment to state my qualifications for commenting on the subject. (Long, awkward silence.)

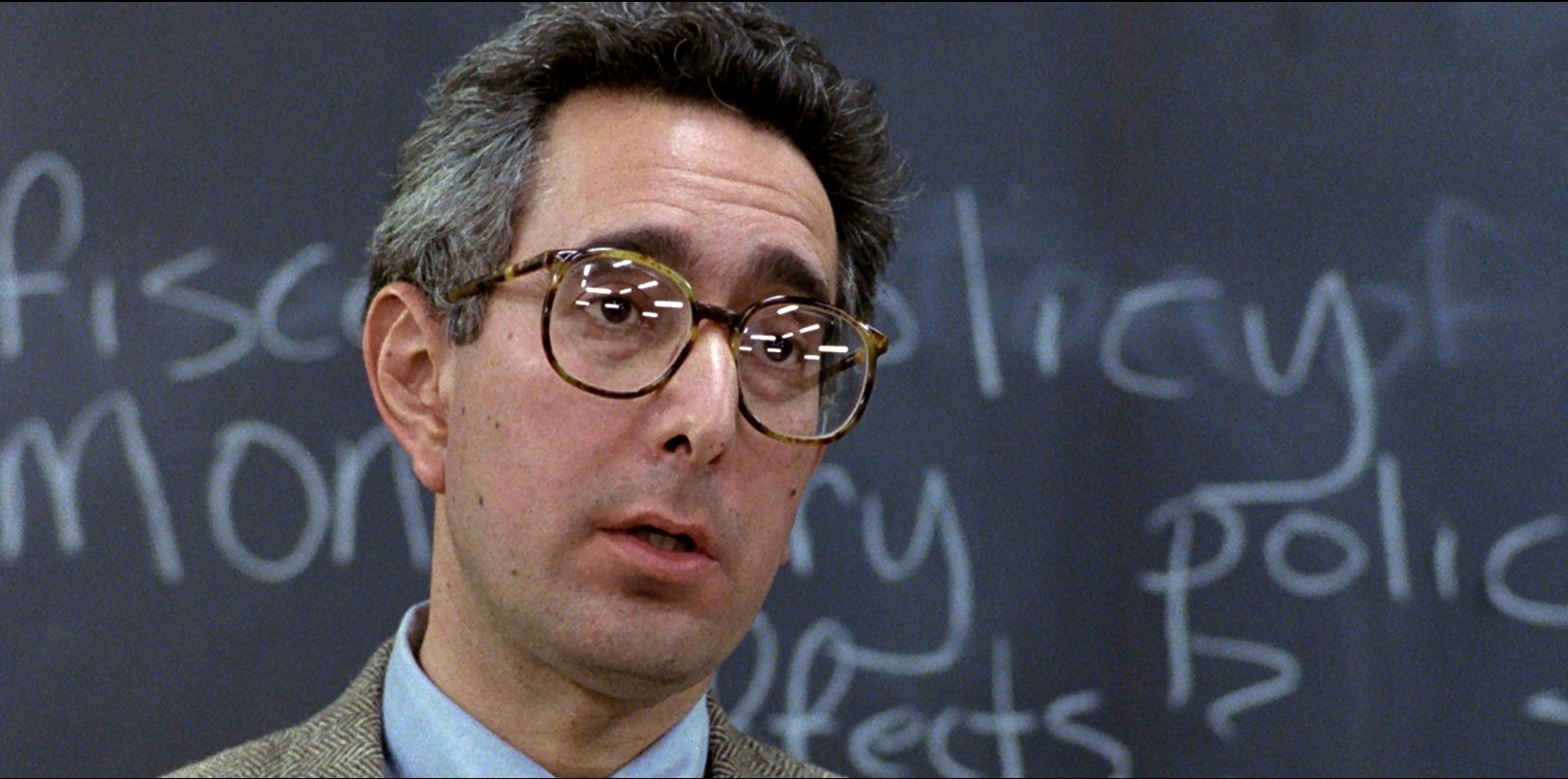

Now that that’s out of the way, I should also say that I mean no disrespect to Keynes, Friedman and the great Ben Stein, who once said, “Greed is a basic part of animal nature. Being against it is like being against breathing or eating” and without whom the words “Bueller? Bueller? Bueller?” would have no meaning.

The problem with macroeconomics as a science is this: It is impossible to do a controlled experiment, ergo it’s impossible to draw any meaningful conclusions. You can implement monetary policy and observe the outcome until the cows come home and still have no idea what effect it had or if it had any effect at all.

Take the Bernanke debate, for example. To avoid deflation and another great depression, the Federal Reserve attempted to stimulate the economy by buying trillions of dollars of mortgage-backed securities, treasury notes, and bank dept. That’s known as quantitative easing. No, I don’t know why they call it that. They just do.

Now everyone is arguing about whether it worked or not and if a different strategy might not have worked better. Fair enough. First let’s start with what we now know, however many years it’s been since this great experiment began:

We know that we are not in a deflationary trend. We know that our economic growth and job market are weak. We know the Dow and S&P 500 are near record levels. We know that our federal deficit is also at a record level. And we know that, from 2004 to 2014, America’s debt-to-GDP ratio rose from 62.7% to 101.5%.

What we don’t know is the effect the Fed’s monetary policy had on the recovery. Even if we assume that quantitative easing changed the outcome, we don’t know to what extent. We don’t know if our recovery wouldn’t have been stronger if we hadn’t bailed out the banks and, instead of passing those pork-filled stimulus bills, stimulated the economy with real shovel-ready infrastructure jobs such as building smart highways and oil pipelines.

The truth is, when you’re experimenting with the economies of nations, you don’t get to have a control group. You don’t get to alter one variable while keeping everything else constant. And you don’t get to repeat the experiment under the same conditions while altering a different variable or the same one by a different amount.

Granted, there will always be another economic crisis, but its causes and effects won’t be the same. Besides, the world and its markets will have changed so much by then that comparisons won’t be effective enough to draw any meaningful conclusions.

Finally, there’s one last data-point I didn’t mention. American companies are sitting on record hordes of cash. Why? Because CEOs and CFOs tend to be a pretty smart, savvy group. And, unlike macroeconomists, they won’t bet the farm on theories that can’t possibly be proven.

The truth is, after all this experimentation with monetary policy, we don’t know what impact it really had and whether we haven’t dug ourselves a deeper hole than we were in before we started. We don’t know because we can’t know. And I’m not the only one who knows that. The smartest business minds in our nation know it too. And they’re about as uncertain about America’s future as they’ve ever been.

A version of this originally appeared on FOXBusiness.com.

I have good news and better news. The good news is that you are absolutely correct that a controlled experiment is impossible. However, there is enough historical data from the last couple millenia that a good statistical correlation is possible. This does not give enough evidence to draw conclusions about individual events or small tweaks to economic policy, but it does give us the ability to draw accurate conclusions regarding general theories. For example, government meddling in the economy has always ended badly. Extreme cases of this include the USSR and the current mess in Venezuela, but the fall of Rome, China’s move toward capitalism, the unnecessary lengthening of our own Great Depression and our failed War on Poverty also provide evidence. If you want more information on an economic theory that has proven reliable (but very unpopular with politicians), please subscribe to the von Mises Institute’s newsletter. It’s a daily commentary on politics and the economy by some brilliant economists with whom you have much in common.